In my role, I am fortunate to have the opportunity to interact with customers at leading retailers and consumer electronics brands in a range of roles from Store Operations, Loss Prevention, Marketing, IT, Product Management, and Design. My opinions on this topic are somewhat formed by data and an understanding of retail trends, however, my perspective is mostly shaped by the frequent conversations with insightful leaders from some of the world’s most recognized brands. The resulting summary of those discussions is that brick and mortar retail is – and will continue to be – vibrant for the foreseeable future. Here are four reasons why:

Retail is growing at a rate not seen over the last 20 years

Consumerism will continue to grow alongside population growth. By 2050 there will be 9.8 billion people in need of goods and services. How we shop for everything from essentials to luxury goods – one, three, or even 10 years from now – will largely be defined by what the industry is preparing for, and doing, right now.

Over the last few years, just as quickly as one store turned off the lights did another cut its inaugural ribbon. In 2021 in the US alone, there were twice as many opening announcements as closing.

Yes, we saw many legacy brands shuttering their storefronts, and there were COVID-19 casualties. But zoom out and you’ll find an industry growth rate that’s notably surpassing the average from the last decade. According to the 2022 NRF forecasts, the industry will grow another 6-8% by the end of 2022, well above the 3.7% average between 2010-2019. This will likely now fall on the low end due to inflation and economic uncertainty, but still, nearly double the previous decade.

With the growth of e-commerce, online retail sales are still only projected to be 15% of total retail sales in 2022. Which is why:

Leading retailers and brands will need to blend a physical and virtual presence strategy to win

It’s no surprise that being confined to our own homes on and off over the last two years pushed e-commerce numbers ahead of their time. Peaking in April 2020, e-commerce accounted for 19% of retail sales. While it has since leveled off, the biggest players from each corner of the industry – storefronts vs. online – are integrating what works best from each side into their omnichannel strategy.

Online behemoth Amazon now has five branded stores (not including Whole Foods). Wayfair made waves with its first All Modern store opening in May, and Warby Parker, a pioneer in direct-to-consumer retail, plans to open 40 new stores this year in key markets. When they do, they are either seeing an uptick in revenue in those geographical areas, staving off the increasing costs of doing business online, or testing out new technologies such as the “just walk out” concept of self-service (more on that below). The Wall Street Journal did an extensive piece describing how the integration of physical stores is now necessary to save a brand’s e-commerce business.

Stores will continue to serve as distribution centers in addition to places to shop

The Amazon effect on shopper expectations is changing how retailers build their logistics operations. Today, more than 90 percent of US online shoppers expect free two- to three-day shipping, and 30% expect same-day delivery.

Now that faster delivery of online orders is becoming a top consumer-facing priority, many are using their existing stores to get there.

Retailers who own real estate can implement the necessary fulfillment strategies needed at a fraction of the cost. Whereas at-scale distribution centers can require upwards of $100 million in capital, transforming 10-50,000 square feet of existing store operations will cost $5-15 million. Then there’s shipping, which is getting even more complex by the day. Using stores as fulfillment centers can be as much as 40% cheaper than using an upstream warehouse.

Take DSW for example, which increased sales by 43% in 2021 by fulfilling nearly 60% of their digital orders from their stores. Today they’re planning to transform 15,000 of their 25,000 square foot stores into fulfillment operations.

Target’s 2017 acquisition of same-day delivery platform Shipt launched the brand’s in-store fulfillment strategy and by 2019, 80% was handled through their stores.

Technology will continue to enable more convenient, compelling, and cost-effective ways to achieve in-store results.

In a time when customers are willing to exchange their information or pay more for greater convenience, it’s hard to believe just three years ago curbside collect and buy online pick up in-store (BOPIS) barely existed.

Now that 44% of US retailers now offer these services, three-quarters of Americans want to continue using them beyond the pandemic.

Amazon’s testing the idea that customers are ready to take it to the next level with their Just Walk Out technology, which they’ve been licensing to other retailers since 2020. Piloting the concept at a handful of Amazon Go stores, the program works much like the name; walk in, grab what you want, and walk out without ever waiting in a checkout line.

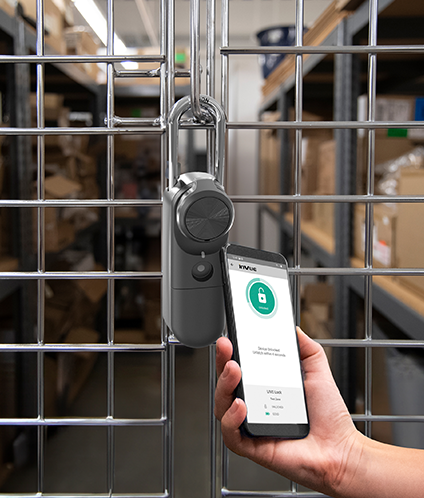

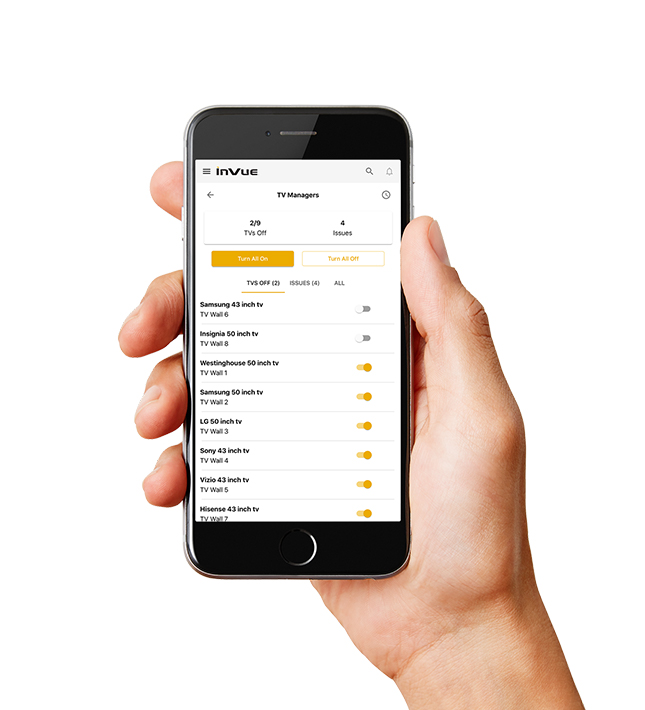

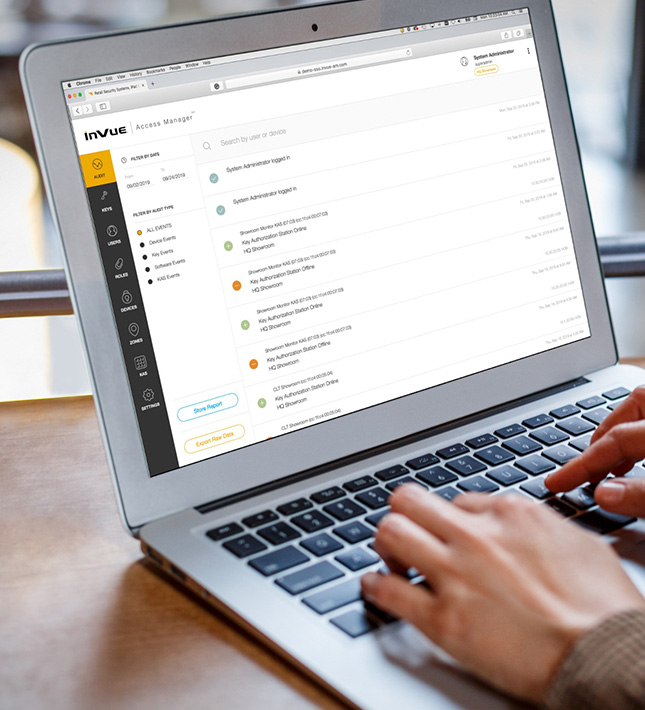

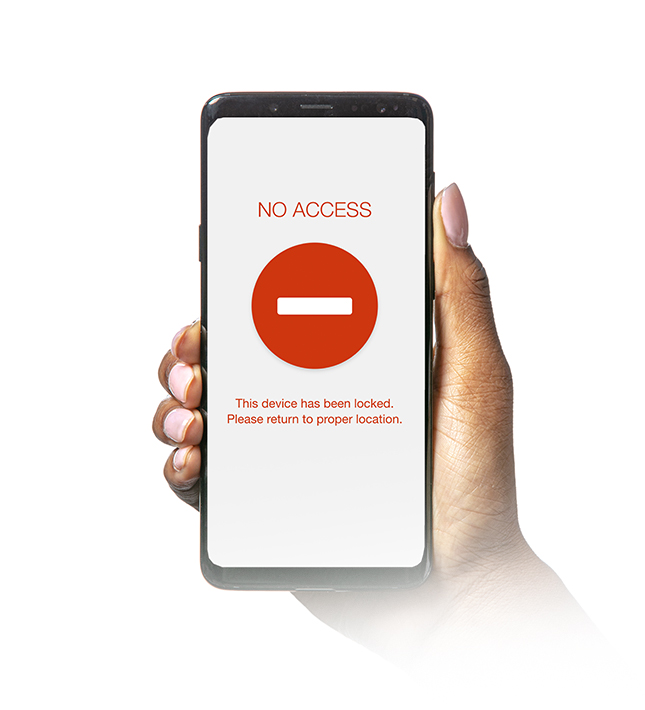

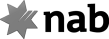

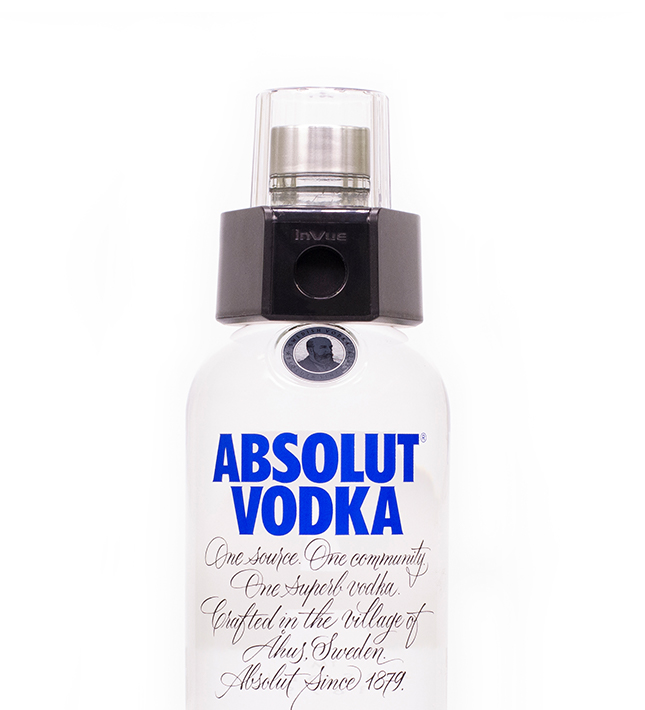

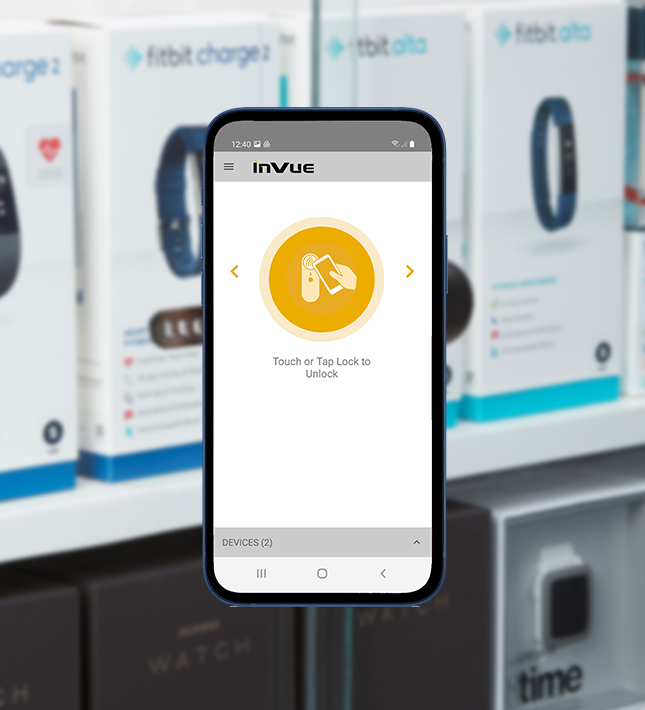

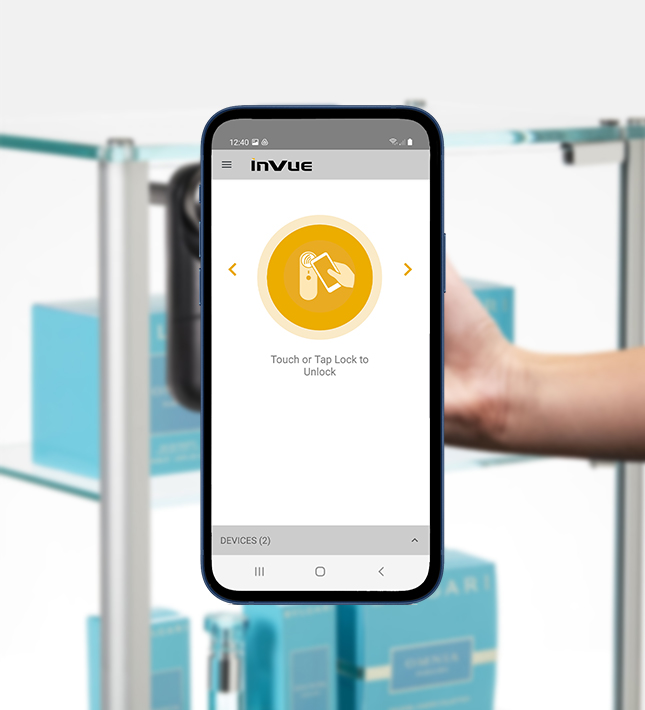

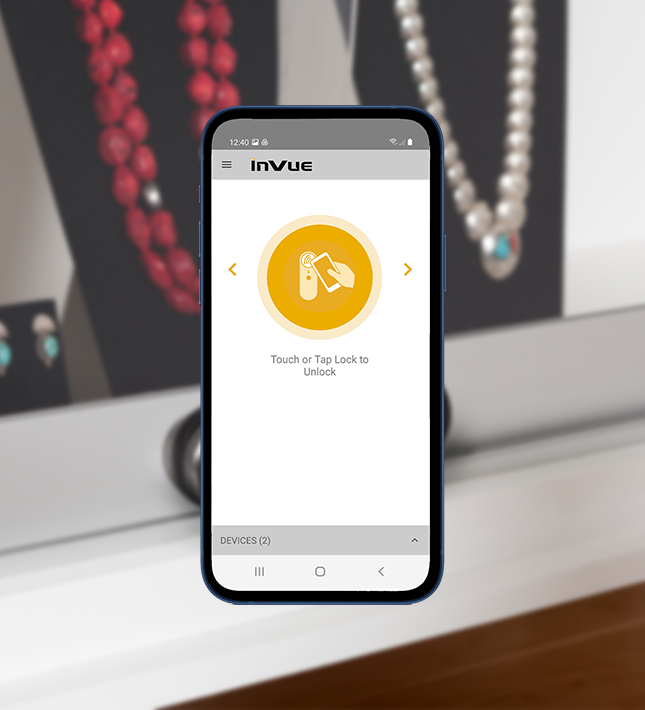

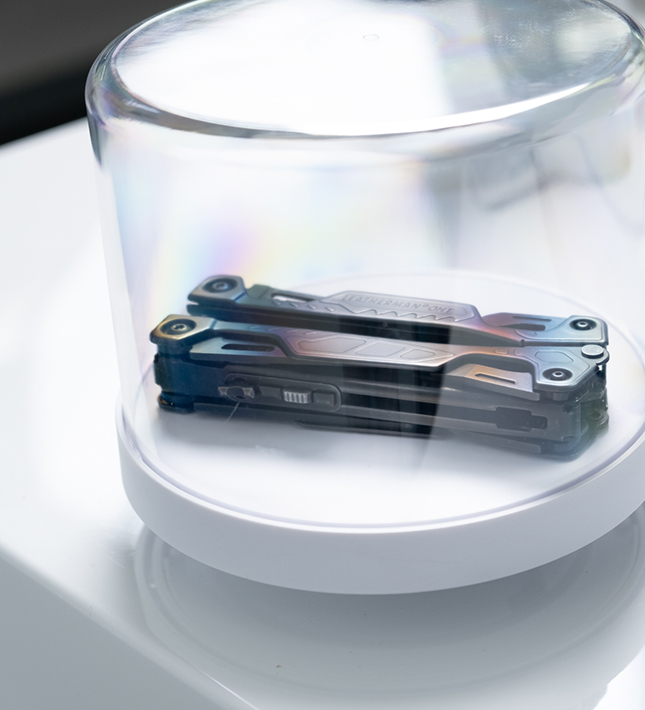

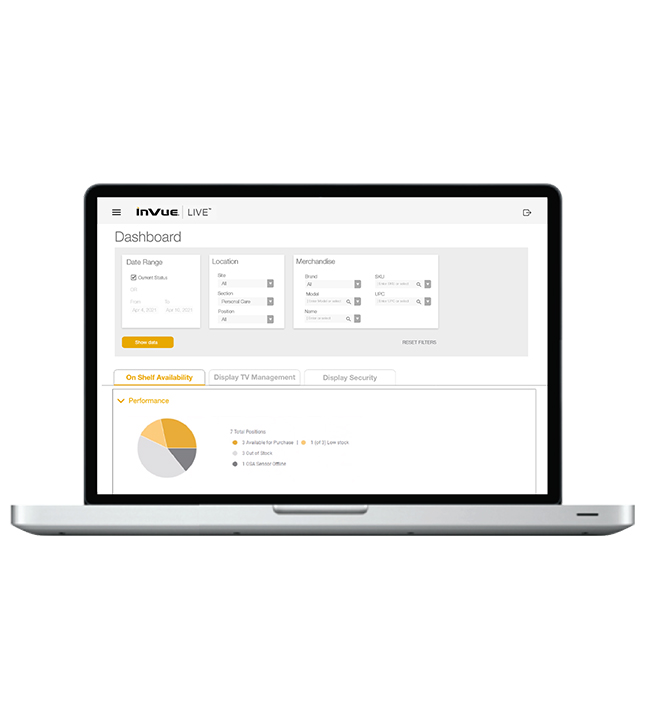

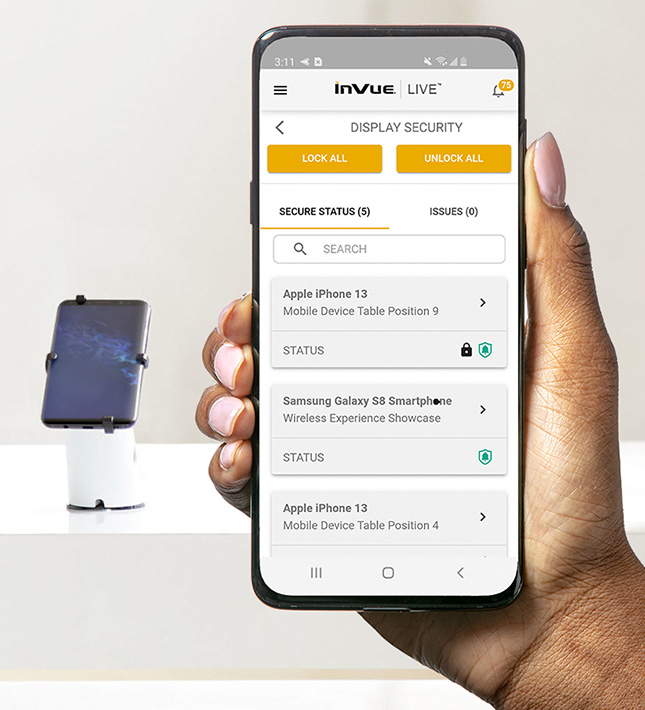

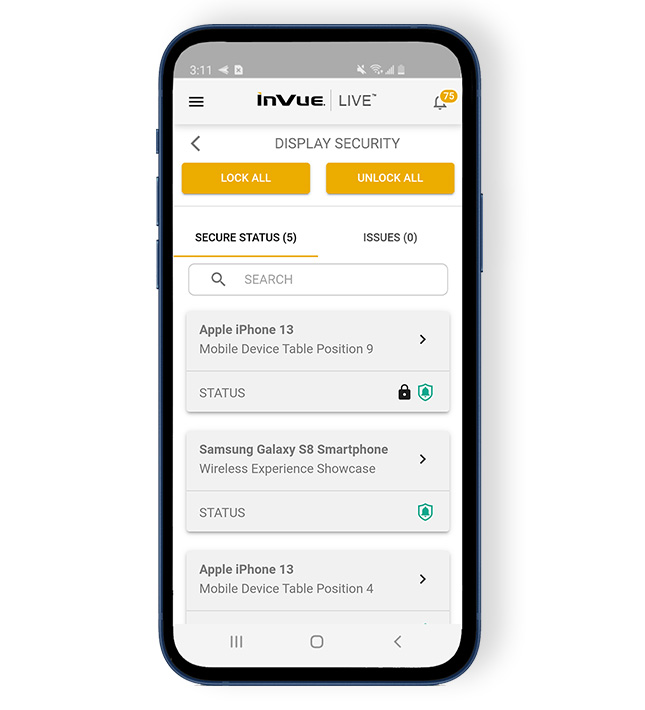

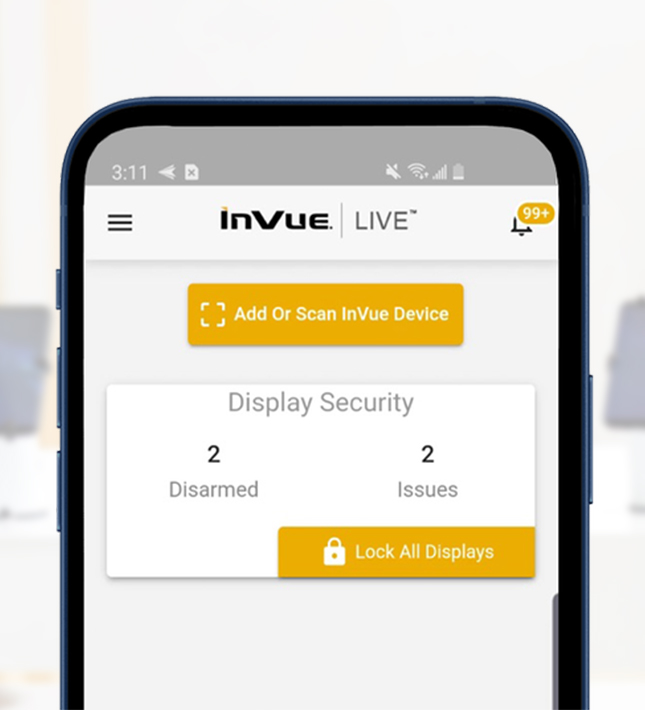

The days of waiting for an associate to unlock merchandise in a store are also numbered. The technology is already being used in U.S hypermarket environments where associates can unlock merchandise for customers by using an app on their phones. The next natural step is to let customers unlock cabinets or lockers on their own within the store’s mobile app. Outside of retail imagine the convenience it would bring to sports and entertainment. Side-step those long queues altogether and order everything from your phone. A text alert tells you what locker your beer and hotdog are in when it’s ready with instructions on how to grab your order without ever interacting with anyone.

While the concept might not be ready for certain pockets of retail, others are preparing for the day that customers have fully caught on – or expect it.

We know that customers have embraced new technologies such as e-commerce, but over the last few years shopper habits have reaffirmed one critical trend: customers still enjoy the physical experience of shopping. The best retailers are paying attention to what conveniences their shoppers want to see, and where the in-store experience fits into their life. Whether shoppers are looking for essential needs or need help deciding on big purchases, there’s a store experience waiting for them.

About the Author

Chris Gibson is the Chief Product & Marketing Officer for InVue, leading Product Management, Marketing, and Innovation to shape connected, intelligent ecosystems which promote and protect assets for the world’s most valuable brands. Prior to InVue, Chris worked as VP of Marketing and Product Management in New York for Humanscale, a leading designer and manufacturer of ergonomic products. Over his tenure at InVue, Humanscale, and General Electric, Chris has led more than 70 new product launches, placing innovative offerings in more than 90 countries.

Chris has lived in 11 cities in the last 25 years (thanks GE!), but now resides in Charlotte, NC with his wife and two daughters.